Out With the Old?

The Life of Rational Economic Man

Read a summary using the INOMICS AI tool

Humanity’s evolving nature has propelled it up the food chain, from prey to planetary predator. Just 60,000 years ago, homo sapiens roamed the earth, insignificant and insecure, their existence of little consequence. Life, as Thomas Hobbes put it, was ‘nasty, brutish, and short’. Fast forward to the present and man’s mark is unmistakable, the dawn of the ‘anthropocene’ testament to mesmerizing advances in technology - and a masochistic disregard for our ecosystems.

However, despite pillaging the planet and endangering our existence, we still find time for solidarity and charity, betraying a nature seemingly as generous as it is destructive. Recent events draw attention to this paradox, coronavirus triggering swells of heart-warming community spirit as well as the hoarding of toilet paper. Which leads to the question: given such a paradox, what, if anything, does it mean to be human?

Philosophers seem unable to muster a unified answer. In fact, little consensus has emerged anywhere - except, that is, among a cadre of economists, whose influence has gone on to define their discipline. The following is the story of how this clique defined their own answer to this question - the story of rational economic man.

His evolution

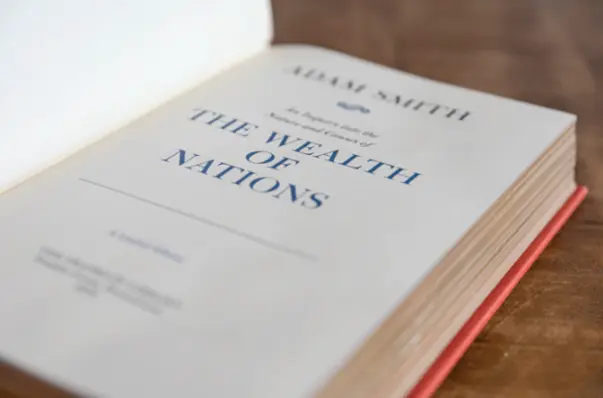

It begins when ‘The Father of Economics’, Adam Smith, wrote about the importance of man’s self interest in making markets work. It’s not, he famously explained in The Wealth of Nations, the benevolence of the butcher, brewer or baker that keeps us fed and refreshed; rather, it’s their selfishness, their pursuit of personal wealth. While acknowledging ‘generosity, justice, and public spirit’ as other, nobler drivers of human behavior, it’s his conception of selfishness that’s best remembered - becoming the first plank of economics’ conception of man.

However, selfishness notwithstanding, man - according to Smith - was still to some degree unpredictable. Economists were, therefore, denied a discrete unit of analysis, and unable to model human behavior with much precision, reducing their work to rough prediction. What economists needed was a constant, their own version of the scientist’s gene, something both simple and predictable. It was thus, with an eye on their scientist colleagues, that they began to define human nature (and reality) to fit their theoretical needs. To gain access to the scientific method, they would first have to reverse it.

Suggested Opportunities

- Summer School

- Posted 2 days ago

Global School in Empirical Research Methods GSERM at the University of St.Gallen

Starts 20 Apr at University of St.Gallen in Sankt Gallen, Switzerland

- Summer School

- Posted 2 weeks ago

BSE Summer School 2026: Economics, Finance, Data Science, and related fields

Starts 22 Jun at Barcelona School of Economics in Barcelona, Spain

- Summer School

- Posted 1 week ago

Summer School 2026: Cognitive Foundations of Decision-Making

Starts 6 Jul in Gent, BelgiumKey to this endeavor’s success was political economist John Stuart Mill, who, in the mid-19th century, developed ‘homo economicus’: a depiction of man that added laziness and a love of luxury to the Smith-endowed desire for wealth. Acknowledging that this formulation overlooked ‘the whole of man’s nature’, and therefore rendered the findings of political economy ‘only true… in the abstract’, Mill claimed it was only through such simplification - collapsing human behavior into a handful of uniform drives - that the emerging field’s true potential would be realized. It was, for this reason, a necessary compromise.

Reliable predictability, however, was still missing - and for that their conception of human nature needed further refinement. In sketching his ‘calculating man’ in the late 1800s, economist William Jevons duly obliged, bestowing man a relentless and unfailing calculus of personal satisfaction. He saw the individual as an insatiable seeker of utility. Though satisfaction from a single activity could be exhausted - owing to the law of diminishing returns - Jevons claimed overall satiation could never be reached; for as man ‘progresses’ (gets richer), so too widens the spectrum of his desires. The individual in this interpretation was endlessly greedy, devoid of social affinity, and a slave to their own need to constantly consume.

During the interwar period, Chicago School economist Frank Knight then added ‘perfect knowledge’ to this already improbable set of traits, and ever-calculating became ever-knowing. The rational economic man was now capable of comparing all goods and prices across all times. With this departure into make-believe, economics’ contemplation on human nature was complete, and the final touches to a unit of analysis now primed for mathematical theorizing were done. Rational economic man as appears in our economics textbooks was born.

Since conception, his life has by and large been a charmed one, withstanding ethical criticism, and buttressed by the popular 20th century view that resources were essentially inexhaustible. And in any case, as Milton Friedman commented in the 1960s, it made little difference whether economics’ abstraction of man was accurate. The economy operated, and people behaved, as though it was - so what was the issue?

His fall

That would soon become clear. Over the years, rational economic man increasingly came to frame both the ends of policy-making, and the means. Success was when he spent more money, gratifying his myriad cravings, and failure was when he spent less. By the same token responsible behavior could be coaxed by financial incentive, known as ‘market-based policy’, and bad behavior disincentivized by financial regulation. It was an encompassing mindset, seductive in its simplicity, and one that was reflected in the governing logic of parties both left and right as the 20th century rumbled on.

But humans respond to more than just carrots and sticks. It’s simply not possible to create a tax bribe for every good thing that needs to happen, nor a regulatory whip to eradicate all that’s bad. Much of our modern world is built on these incentives, and look around: it’s a world defined by a climate emergency, excessive consumption, and global inequality. At a time when we need compassion, collaboration, and restraint, economics is too often based on a conception of man defined by selfishness, disregard and greed. He is no longer fit for purpose.

And he never was. As writer Johnathon Rowe summarily concluded: ‘rational economic man is not the result of dispassionate inquiry into human nature… he’s the result of a drive for influence…[and was] designed in a by-gone time.’ Given the enormity of the challenges we face, it’s time for a reset. We need a new approach to funneling human energies toward human needs, one that recognizes the complexity of humankind - however undefinable - and appreciates our dependency on the natural world, reciprocity, and community.

Moves towards behavioral economics are positive. But the rational economic man remains, especially in the US, a textbook staple and bedrock of policy, revealing the lingering esteem in which he’s still held. Looking into a post-COVID future, if economics is to achieve the credibility it so craves, that esteem must be snuffed out.

The above article first appeared in the INOMICS Handbook 2021, which you can download on our site.

-

- Conference

- Posted 1 week ago

46th RSEP International Conference on Economics, Finance and Business

Between 17 Apr and 18 Apr in Paris, France

-

- Workshop

- Posted 1 week ago

Geopolitical Alignment, Tensions, and the Global Economy (Measurement and Evidence)

Between 4 Dec and 4 Dec in Nanterre, France -

- PhD Candidate Job

- Posted 1 week ago

Researcher in Economic Theory and Policy, Behavioural Economics, Empirical Economics, or Econometrics (75 %; EG 13 TV-L)

At Düsseldorf Institute for Competition Economics (DICE) - University of Düsseldorf in Düsseldorf, Germany