Economics Terms A-Z

Externalities

Read a summary or generate practice questions using the INOMICS AI tool

Externalities are costs (negative externalities) or benefits (positive externalities) of market transactions that are not reflected in the market price and that affect individuals who are not participating in the market. Depending on the allocation of property rights in the economy, the presence of externalities is addressed through negotiation between the affected parties and/or government intervention in the market.

Within free-market economies, market players act via the relevant mechanism or accepted system of determining prices and quantities bought and sold in the market. Occasionally, the actions of market players affect the welfare of individuals and groups who are not directly involved in the market. Such effects are called externalities because they are external to the market.

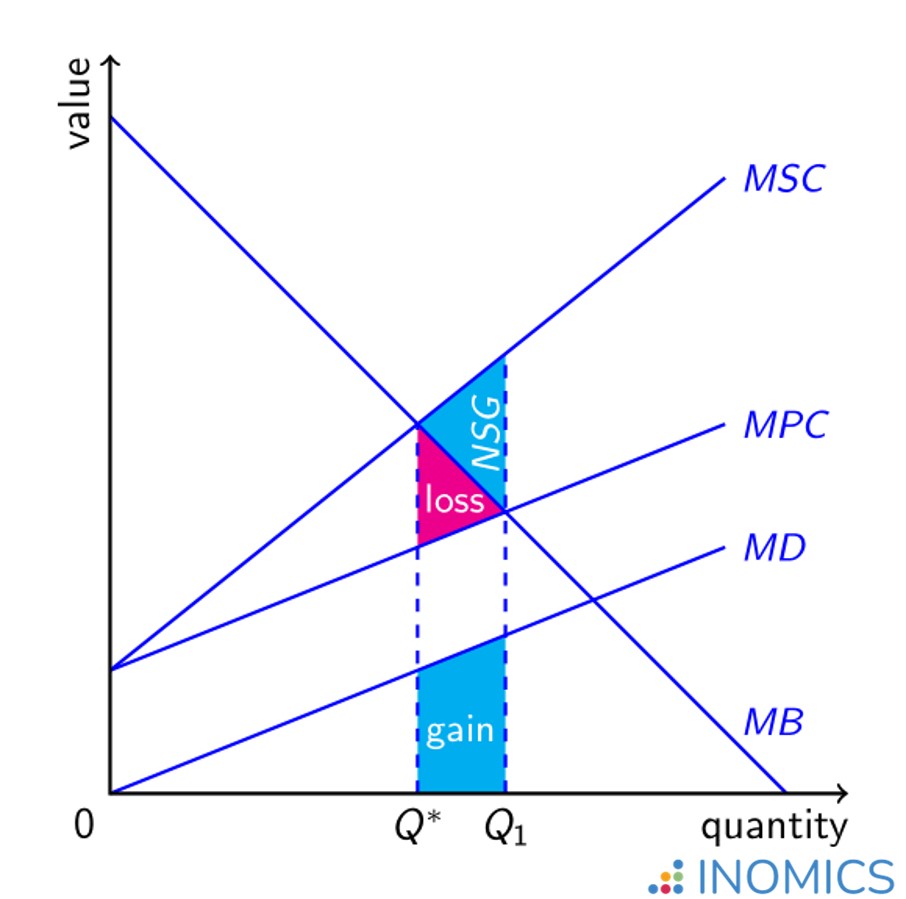

For example, the production of particleboard releases toxic chemical waste into the environment. If producers and consumers are left to negotiate prices freely then the cost of this externality, the environmental damage, will be ignored. Other individuals and groups in the economy who have no need for particleboard will suffer the externality without compensation. This situation is illustrated in the graph: the equilibrium quantity of particle board in the market \(Q_{1}\) is determined where the marginal benefit (\(MB\)), or marginal revenue, to producers equals their marginal private cost (\(MPC\)).

If the environmental damage can be costed then for each unit of particleboard produced the additional toxic waste and associated marginal damage (\(MD\)) can also be included in the graph. It follows that the additional cost to society as a whole from the market for particleboard, its marginal social cost (\(MSC\)), is the sum of the marginal private cost and the marginal damage\[MSC=MPC+MD.\]

A new socially optimal equilibrium quantity \(Q^{*}\) is determined, taking into account the externality, where the marginal benefit from particleboard production is equal to its marginal social cost. Note that while this quantity \(Q^{*}\) is less than the free-market quantity \(Q_{1}\) it is nevertheless still positive, i.e. it is socially optimal to produce some particleboard. This is because some members of society, namely the producers and consumers of particleboard, stand to gain from it. A compromise is met in which the costs and benefits are simply set against each other from a social perspective.

In the above example it is in society’s interest to move from the free-market equilibrium \(Q_{1}\) to the socially optimal equilibrium \(Q^{*}\). This can be seen by quantifying the loss to particleboard market participants in terms of forgone consumer and producer surplus, represented by the pink triangle in the graph, and subtracting it from the reduction in damage, represented by the shaded blue area under \(MD\) in the graph. The result is a positive net social gain (\(NSG\)), which, as shown in the blue triangle between \(MSC\) and \(MB\) in the graph, is also equal to the reduction in social cost minus the reduction in (private) benefit to market participants when moving from \(Q_{1}\) to \(Q^{*}\).

Figure 1: Net social gain from "correcting" an externality

The obvious question, once one has established the presence of an externality and the existence of a socially optimal equilibrium, is how to get there. More often than not a public (government) response to the externality is required, however, in some cases a private response will be sufficient. In free-market economies, firms that cause general forms of pollution through their operations are often taxed by the government, to compensate society for the environmental damage.

The value of the marginal damage is paid back by the firm to society through the tax, and as a result of the effective increase in their costs, firms decide to reduce production.

An alternative public solution is for government to allocate a fixed number of pollution rights and to charge firms for the right to produce and cause a limited amount of pollution (here, the ‘socially acceptable’ amount caused by producing \(Q^{*}\) in the graph). Such rights can be auctioned and allocated to the highest bidder, in order to maximise compensation to society for the damage.

Each of these solutions effectively ‘internalizes’ the externality back into the market such that the socially optimal equilibrium is preferred by market participants over the original free-market equilibrium.

In certain instances, the externality only affects one or a few other members of society. A classic example of externalities is that of a river flowing in a remote part of the country where people fish for food. People living upstream may catch fish before the fish swim downstream so people living downstream have none left to catch. In such cases it is important to have clarity on who owns the rights to the fish in the river, in order to avoid conflict over what then becomes a scarce resource.

Yet as long as property rights are properly assigned and upheld by law, and it is not costly for individuals to bargain with one another over these rights, it will not be necessary for the government to intervene any further to manage the externality caused by over-fishing. The individuals affected will sort it out on their own.

This laissez-faire solution to the problem of externalities has come to be known as the Coase Theorem after the late economist and Nobel laureate Ronald Coase who described it in “The Problem of Social Cost” (Journal of Law and Economics, 1960).

Further reading

The problem of externalities in economics and the Coase Theorem are discussed in detail in chapter 5 of Public Finance by Harvey Rosen and Ted Gayer (10th edition, 2013).

Good to know

As already mentioned, externalities can also be positive. For example, a farmer planting orange trees to grow and sell oranges will be providing new nectar and pollen sources for bees, which benefits the local ecosystem and everyone living in the area. It may be in society’s interest to encourage a greater production of orange trees than the farmer would choose if left simply to the market for oranges.

In such cases of potential marginal social benefit, the government can offer subsidies to farmers to increase production. Of course, subsidies also require financing so it is important to quantify the social benefits, and weigh them against any costs when making policy decisions.

-

- Postdoc Job

- Posted 1 month ago

Postdoctoral position in applied microeconomics (80%)

At University of Neuchâtel (Switzerland), Faculty of Economics in Neuchâtel, Switzerland

-

- Postdoc Job

- Posted 1 week ago

6-Year Postdoc with Option for a PermanentContract (f/m/d, 100%)

At ZEW – Leibniz-Zentrum für Europäische Wirtschaftsforschung GmbH Mannheim in Mannheim, Germany

-

- Conference

- Posted 1 week ago

Macroeconomic Policy in a Heterogeneous and Imperfectly Rational World - 6th Joint NBP-LB-CEBRA Biennial Conference

Between 24 Sep and 25 Sep in Warsaw, Poland