Economics Terms A-Z

Price Discrimination

Read a summary or generate practice questions using the INOMICS AI tool

Price discrimination is a pricing strategy in which firms charge different prices for the same physical good or service to different consumers or to the same consumer. By doing so, firms can increase their profits compared to selling each unit of the good at the same price.

If and how a firm can successfully price discriminate depends crucially on the information that the firm has about its customers and on the possibilities of the consumers to engage in arbitrage. Note that it is not price discrimination if price differences reflect differences in the costs of serving those consumers. Price discrimination is usually studied in a monopoly, though oligopolies and even regular markets often exhibit price discrimination as well. We distinguish between three different types of price discrimination:

First degree price discrimination

First degree price discrimination is also called perfect price discrimination. From the perspective of the firm this type of price discrimination yields the highest possible profit. To perform first degree price discrimination the monopolist needs to know the exact willingness-to-pay or demand function of each of its consumers and it has to be able to perfectly distinguish the customers from each other (i.e. no customer can lie about his true willingness-to-pay).

If these conditions are true, the monopolist can charge each consumer exactly their maximum willingness-to-pay for the good. Remember from the demand curve that each consumer has a different willingness to pay, or preference, for goods.

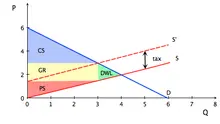

Clearly, if the monopolist charges every consumer their exact willingness-to-pay, individual consumers will be worse off than without price discrimination because consumer surplus in this case is zero. That is, by perfectly price discriminating, the monopolist captures the entire surplus.

But, this is still a Pareto efficient outcome even though consumers are worse off individually. The quantity exchanged will be the same as in perfect competition which means that there is no efficiency loss or deadweight loss if a monopolist can perfectly price discriminate. Certain consumers end up paying more than they would have under perfect competition, and the surplus they would have enjoyed goes to the monopolist instead. But, total utility from the market remains unchanged (it’s only been redistributed to the monopolist), which makes this situation still Pareto efficient.

Perfect price discrimination is rare, because firms rarely possess perfect information about the exact willingness-to-pay of each customer. Additionally, the possibility of arbitrage might prevent the monopolist from discriminating between consumers. Arbitrage means that the consumers can exploit the differences in prices.

There are two possible types of arbitrage that may prevent price discrimination: First, consumers may be able to resell the good to other consumers. Consumers who can buy at a lower price would do so and then resell the good to consumers who were supposed to pay a higher price.

Second, consumers may pretend to have a lower willingness-to-pay than they actually do. That is why for first-degree price discrimination to work, the monopolist needs to know the exact willingness-to-pay of each single customer personally.

Now you may wonder whether there are even situations in which first-degree price discrimination is possible. One situation in which perfect price discrimination may be possible is when the exchange of the good involves bargaining or haggling between the buyer and seller (e.g. on a flea market). A skilled seller may be able to sell his or her goods at a price that is very close to the maximum willingness-to-pay of the consumer.

Another example is when determining the price of a completely new good or service, where the potential buyers have difficulties evaluating the product due to lack of experience. In this scenario a monopolist might be able to extract the entire consumer surplus. Think, for example, about a firm who is going to buy a completely new piece of software or use a novel technology to reduce production costs for the first time. This firm probably does not yet know how this change will impact profits and costs, and has limited experience with the technology, so may not know what price meets its needs the best.

Second degree price discrimination

In the case of second-degree price discrimination, the firm knows that it has different types of customers (because of a market survey or experience) and knows the willingness-to-pay or demand function of each type of customer.

But, in contrast to third-degree price discrimination, the firm cannot distinguish between consumers of different types and therefore cannot charge a different price to each group. To maximize profits, the firm will offer different options and let the consumers decide themselves which of the options to buy. The prices are designed in such a way that consumers of different types will choose different options.

An example are quantity discounts. We all have already come across offers such as “Buy 3 for the price of 2”. Why does it make sense for the firm to offer such deals?

This makes sense if the firm knows that some consumers usually like to buy one unit, but that by offering the third unit “for free”, they might be encouraged to buy the second unit. Other examples of second-degree price discrimination include sales (a famous one is Black Friday), bundling or tying.

Third degree price discrimination

Third degree price discrimination is used to describe the common practice of charging a different price to different groups of customers, for instance offering a student discount. The firm faces different groups of customers and knows the aggregate demand function of each group. Customers might be grouped according to age, occupation, gender, location, religion, language, etc.

The firm can tell its customers apart by using a signal. For example, in order to benefit from a reduced price for students, you normally have to present your student ID. Then the firm simply charges a different price for each group of customers. The mark-up that the firm charges will be higher in groups with a lower price elasticity of demand (more inelastic).

Third degree price discrimination is the preferred option for the firm if they cannot discriminate within a particular group. So even if the firm knows that some students are more price sensitive than others, it cannot charge a different price within the group of students, because it cannot tell them apart and therefore the students might engage in arbitrage.

Charging different prices to different groups of customers only works if customers who obtain the lower price cannot resell the good to customers who should pay the higher price. When you think about examples of third degree price discrimination, you'll soon realize that in most of them reselling isn't possible. For example, if you get a reduced price entry into a museum, you have to present your student ID when buying the ticket and also when entering the museum. This means that you cannot buy the ticket at a reduced price and resell it to a non-student, because he or she wouldn't be allowed to enter with the reduced-price ticket.

The monopolist's profit with third degree price discrimination is higher than without price discrimination. Consumer surplus may increase or decrease. Consumers who are more price sensitive are better off with price discrimination, because they will get a lower price than otherwise (the student discounts, for example). But consumers who are less price sensitive will be worse off, because they will pay a higher price with price discrimination than without.

Further reading

Price discrimination is very common in practice; we observe it every day in the supermarket, when buying tickets to concerts or museums, when buying a plane ticket or booking a holiday. In fact, most companies price discriminate somehow.

One important question is whether discrimination in prices targets the same groups that face discrimination in other aspects as well, e.g. people of color, women, people with disabilities or certain religious beliefs, etc. Price discrimination is usually not illegal, but it can be if it’s based upon characteristics of buyers that are illegal to discriminate against like these. For example, Goldberg (1996) studied dealer price discrimination in new car purchases and found no evidence that the buyers' characteristics determine dealer discounts, but rather the characteristics of the car and the purchase itself.

Good to know

We all know how tedious it can be to book a plane ticket with a low-cost airline. The fare that you see in the search engine rarely reflects the price you will end up paying, because you have to pay extra for literally everything: Luggage (hand luggage and checked luggage separately of course), a preferred seat (includes sitting next to your travel companions), food, credit card fees, insurance, and so forth.

Who do you think came up with this type of pricing strategy? Some clever economists, who know that different consumers have a different willingness-to-pay for different services and therefore additional consumer surplus can be extracted by designing the prices in a clever way. If you assign people traveling together to seats in different rows, many of them will be willing to pay some extra money to be able to sit next to each other.

-

- Research Assistant / Technician Job

- Posted 3 days ago

Research Assistant on a part-time basis (50%) for our Research Centre

At Deutsche Bundesbank in Frankfurt am Main, Germany en de

-

- PhD Candidate Job

- Posted 1 month ago

PhD Candidate in Impact Evaluation of Welfare Programs

At NTNU: Norwegian University of Science and Technology in Trondheim, Norway

-

- Conference

- Posted 4 days ago

Industrial Policies in a Globalized and Financialized World

Between 7 May and 8 May