Economics Terms A-Z

Deadweight Loss

Read a summary or generate practice questions using the INOMICS AI tool

A deadweight loss is the cost to society from economic inefficiency that occurs when a free-market equilibrium cannot be reached. This can be due to a market intervention like a price ceiling, the dominance of a monopoly, or some other shock to supply and/or demand.

In economic theory, free markets are beneficial to society because they allow consumers and producers to exchange goods and services for money according to their own maximization of personal utility. Both sides of the market gain at the equilibrium price; we call these gains consumer surplus and producer surplus. In a simple economy with just one market, the sum of consumer and producer surplus equates to social welfare: the market is then understood to be doing something good for society.

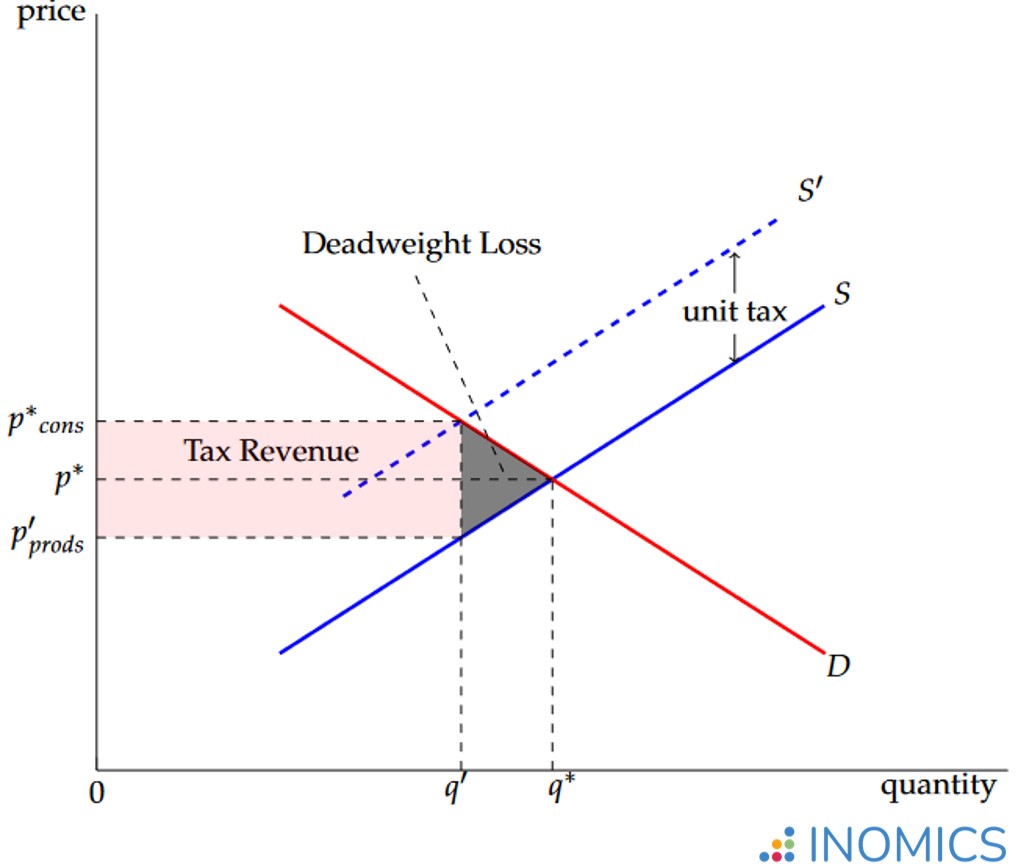

If the government decides to intervene in a market, for example by levying a tax on an item which is being sold by producers to consumers, then this will force a new equilibrium in the market. Consider the market in the graph below, with producer supply S, consumer demand D and a free-market equilibrium of q* units sold at p* per unit. If the government introduces a simple unit tax (a certain amount of tax per unit of the item sold) to be collected from the producers, this forces a parallel shift of the supply to the left and an effective new supply curve of S’. This shift occurs because the tax increases the cost of selling the item, which reduces the amount of the item that producers wish to sell as they make less profit off of it.

The new equilibrium point is where D crosses S’ at a quantity q’ and a retail or consumer price of p’cons. Although the item is sold at price p’cons this new price includes the tax and the producer only receives the price p’prod per unit. The government then receives (p’cons – p’prod)q’ in tax revenue.

Figure 1: Deadweight loss produced from a tax on a competitive market

Note how the new quantity q’ is less than the original quantity q* (since less of the item is bought at a higher price). Therefore both consumer surplus and producer surplus are reduced. Some of the original consumer surplus and producer surplus has been transformed into tax revenue for the government. However, the government is not able to recoup all of the reduction in total surplus from the original free-market equilibrium. This is because the tax induces less of the item to be exchanged in the market. Some of the benefits to market participants from the original equilibrium have simply vanished as some units are no longer traded at all. This is represented by the gray shaded triangle in the graph and it is known as the excess burden of the tax, or a deadweight loss. The size of the deadweight loss is determined by the elasticities of supply and demand.

A deadweight loss is a loss in economic efficiency: before the unit tax, social welfare was higher than after its introduction. Deadweight losses, which are caused by market interventions, are often cited by proponents of a free market economy when arguing for smaller government, less regulation and lower taxes.

However, such arguments tend to be somewhat simplistic. In reality, economies are made up of many markets and the actions of participants in one market often have implications for individuals elsewhere in the economy. Government interventions can be very practical responses to market failure. If the market in the example above were that for cigarettes and it were left unregulated and untaxed, cigarette producers and smokers would benefit from their respective surpluses. A unit tax on cigarette packs would reduce those surpluses and there could be a deadweight loss in the market.

Yet smoking causes illness and in a society where healthcare is publicly provided, the treatment of smokers’ conditions has to be financed. In addition to the smokers’ potential health problems (the care of which must be funded by taxpayers), they produce another negative externality - secondhand smoke - that may cause health problems for other individuals who are not participating in the cigarette market. Externalities like this one often require taxes to force the market to achieve the socially optimal level of trade. In this case, the unit tax on cigarette packs would reduce the number of cigarettes sold as well as the amount of negative externality produced. Thus, it may be beneficial to society as a whole to have a unit tax on cigarette packs. This shows how a deadweight loss in one market, while still an irrecoverable reduction in efficiency in that particular market, can sometimes be compensated by gains elsewhere in the economy.

Further reading

Some economists claim that the act of gift-giving is economically inefficient since the giver is typically not perfectly informed about the recipient’s preferences. Logically, a transfer of money that allows the recipient to choose items for themselves would be more efficient than a guess by the giver as to what items the recipient likes. Projected to whole markets at festive times of the year when (non-monetary) gifts are exchanged, this can invoke deadweight losses in the economy. See Joel Waldfogel’s provocative article, “The Deadweight Loss of Christmas” (American Economic Review, 1993).

Good to know

Some governments restrict the supply of knowledge, e.g. through book-burning, the blocking of internet sites or excessive control of school curricula. This generally results in a significant deadweight loss for society. While such acts may allow governments to achieve certain short-term aims, reducing knowledge in society will stymie progress and growth, making the economy less competitive in the long run. Reinventing the wheel is always inefficient!

-

- Conference

- Posted 2 weeks ago

46th RSEP International Conference on Economics, Finance and Business

Between 17 Apr and 18 Apr in Paris, France

-

- Workshop

- Posted 1 week ago

Call for Papers. The Legacy of Adam Smith Workshop | 22 June 2026 | Edinburgh

22 Jun in Edinburgh, United Kingdom

-

- PhD Candidate Job

- Posted 2 weeks ago

Researcher in Economic Theory and Policy, Behavioural Economics, Empirical Economics, or Econometrics (75 %; EG 13 TV-L)

At Düsseldorf Institute for Competition Economics (DICE) - University of Düsseldorf in Düsseldorf, Germany