Economic Schools of Thought

Austrian Economics: Historical Contributions and Modern Warnings

Read a summary using the INOMICS AI tool

There are many schools of thought in economics. Each rallies around one or more different theories about how the world works, and builds models to support those theories and explain the economy. These schools include the (neo)classical, (neo)Keynesian, monetarist, and Chicago schools. Readers may have heard about the Austrian school of thought as well.

Although these “schools” are separately defined, many modern economists probably consider themselves to fall into an ideological mix of several, and theories from a school can be useful even if an economist considers themselves a “member” of another.

This article focuses on the latter of these schools of thought, which happens to be set apart from the others in a unique way. Austrian economics is considered “heterodox”, or not mainstream. The Austrian school of economics may not even be considered legitimate economics by some modern economists. This article provides a brief history of the school, its contributions to economic theory and the reasons it’s generally no longer considered orthodox. Finally, there is a gentle warning about how the label may be misused in modern discourse.

Defining Austrian economics

To an Austrian economist, economics is about individual people making choices based on their preferences – in other words, human behavior (or “praxeology”, as Austrian school thinkers like to reference). Austrian economists are often also concerned with the unintended consequences of these individual choices, which have lasting effects on economic activity.

Due to this concept of unintended consequences, Austrian economists tend to purport the idea that economic institutions form in unintentional and inefficient ways, as the result of individual agents’ own decisions and actions. In this view, it’s no one person who designs the economic systems we put in place – rather, they result as a by-product of the self-interested actions that individuals take.

Then, because these systems are not purposefully designed, and because it’s impossible to know the preferences and utilities of every individual, Austrian economists tend to believe that government activity is usually harmful. In this way, they agree with classical economists who believe that government intervention is neutral at best.

However, Austrian school economists disagree with the classical economists on other key ideas; the classicals believe that money is neutral, while the Austrians assert that money is not neutral at all (similar to the monetarists).

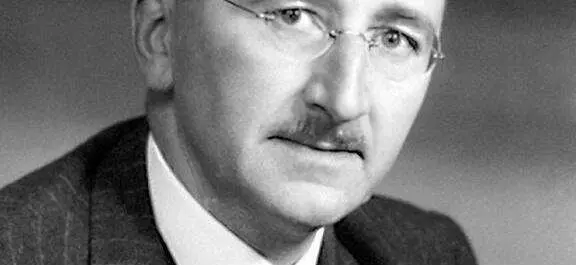

In the present day, there are two major camps of Austrian thinkers, with two historical figures acting as their guide. One camp functions as stated already, being staunchly against government intervention and rejecting much of neoclassical economic theory. They follow the philosophies of Ludwig von Mises and Murray Rothbard. The other camp is more lax about these concepts and may not always be against intervention, though they certainly don’t promote it as (neo-)Keynesians would. These Austrians accept more of neoclassical economics than the others, and follow the thinking of Friedrich Hayek, who won the Nobel Prize in 1974 for his contributions to “the theory of money and economic fluctuations” (alongside Gunnar Myrdal).

Austrian economists believe that economic truths can be learned by conducting “thought experiments” that don’t have to rely on data. This involves using logic and reasoning to postulate their theories. Austrian economists therefore tend to downplay (or altogether reject) the role of econometrics and data in economics – as many of them believe that human behavior cannot be modeled effectively in mathematics as conveniently as many orthodox economic theories attempt to.

Image credit: Pixabay.

In the modern age, this stands in stark contrast to mainstream, orthodox economics, where empirical evidence and quantitative skills are considered critically important to support or discredit economic theories and models. Modern academic research prizes falsifiable hypotheses and quantitative analysis to support theories, so these skills remain crucial for economists hoping to publish in top journals. This is, of course, a relatively recent development; economists began to favor econometric methods more heavily in the mid-twentieth century. Until then, most economists’ methods were much more similar to those of Austrian economists.

Yet, more recently Austrian economists have tended to reject some economic theories and concepts that are widely accepted by those in the mainstream, further separating them ideologically. For example, many Austrian thinkers would reject the idea that the free market can be inefficient, while the majority of mainstream economists would agree that externalities, asymmetric information, and more can make markets inefficient (though of course, they may disagree about the best interventions to solve the problem, if any!).

The vast majority of professional economists today consider themselves non-Austrian, and would consider Austrian economics at its best to be misguided. Economist Leland Yeager wrote that he opposed Austrian economists’ “...ultra-subjectivism in value theory and particularly in interest-rate theory, their insistence on unidirectional causality rather than general interdependence, and their fondness for methodological brooding, pointless profundities, and verbal gymnastics"1.

Similarly, economist Paul A. Samuelson wrote that “...the exaggerated claims that used to be made in economics for the power of deduction and a priori reasoning…Fortunately, we have left that behind us.”2 However, this ideological divide was not always so stark.

The beginnings of Austrian economics

Austrian economics is widely considered to have begun upon the completion of Carl Menger’s Principles of Economics, which was published in 1871. This work put forth the idea that the logic of individual choices, even when those choices are uniquely human and not “economically rational”, should form the basis of economic analysis.

Nevertheless, although he is considered the “father” of the Austrian school, Menger himself wasn’t necessarily opposed to or opposed by mainstream economists of his time. He dedicated his seminal work to a prominent German economist (William Roscher), who at the time belonged to a philosophical camp that touted historical evidence as key to learning economic truths and proving theories. This camp became a major force opposing the emergence of Austrian economics, which argued that historical facts were merely illustrative of human behavior, but that theory alone should be relied upon. In fact, it was these German “historical school” economists who labeled Menger’s ideas as “Austrian economics” in the first place. The term was meant to be derogatory, but it was later adopted by Austrian economists, who began using it to label themselves.

Contributions of Austrian economists

Economists used to be quite limited in their ability to conduct quantitative analysis, when calculators and computers weren’t widely available. Conducting procedures like regression analysis by hand can be extraordinarily tedious, and being forced to research economic data by finding historical records in libraries was much more time-consuming than downloading an economic dataset from the Internet. It should be no surprise, then, that Austrian theories and methods – that don’t always rely on empirical evidence – were quite relevant and more accepted by economists in the past, as they reflected mainstream approaches of the time.

In fact, Austrian economists have contributed to theories and ideas that support what is very much considered orthodox today. For example, Austrian ideas are credited with influencing the “Marginal Revolution” in economics, which occurred in the late 1800s and introduced the now-mainstream idea of “thinking on the margin” or “marginal analysis” to economics.

For example, the “father of Austrian economics” himself, Carl Menger, is partially credited – alongside famous economists such as Léon Walras – with developing the idea of marginal analysis. The “Marginal Revolution” (or marginalist revolution) introduced concepts like the theory of marginal utility for the first time. These ideas showed that economic agents make decisions based on their consumption of the “next unit”, as they weigh the costs and benefits of each action they take. Core economics concepts such as diminishing marginal returns sprang from this period, and continue to be widely acknowledged and taught in mainstream economics today.

Opportunity cost is another example of an economic theory first introduced by an Austrian economist, as it’s attributed to Friedrich von Wieser, an Austrian economist who formulated the idea around the same time, in the late 19th century.

Therefore, it’s undeniable that Austrian economists in the past have contributed to the development of the field of economics today. And, Friedrich Hayek winning the Nobel Prize in Economic Sciences in 1974 gave a brief resurgence of legitimacy to the Austrian school. But even by that point, Austrian economics was widely considered heterodox by most professional economists.

As time went on, and as math, statistics and econometrics became increasingly important in economics, the majority of economists came to believe that quantitative analysis of empirical data is a key tool to furthering our understanding of the economy. As a result, Austrian economics is now considered heterodox in large part due to what other economists would call a lack of empirical rigor (of course, some Austrian economists may actually use empirical methods and so argue this point, but the school overall remains less committed to empirical evidence than many modern economists are comfortable with).

The accusations run in both directions; Austrian economists have levied critiques against mainstream economists, as well. According to some Austrian economists, orthodox schools of thought fail to account for the unintended consequences of economic policy or individual choice. Others would claim that an over-dependence on quantitative rigor has led modern economics astray.

Image credit: master1305 on Freepik.com.

While it’s not correct to “throw the baby out with the bath water” with regards to quantitative methods in economics, there may be some merit to this latter claim. Occasionally, mainstream economics is criticized by other actors as well for failing to see the “big picture” from among the strings of equations and data. One example of this is the 2008 financial crisis that precipitated the Great Recession. Very few economists correctly predicted the crisis or warned about the weaknesses in the global financial system.

Arguably, a lack of “big picture” thinking partly led to the failure of economics to prevent catastrophe. This illustrates how economists should be careful not to get caught fully up in data or empiricism so they can still see the whole picture – though of course, data and empirical analysis are key tools when used properly. Finally, other factors (like corporate greed and lax legislation) were arguably much more to blame for the crisis than economists' failure to raise the alarm about the economy, although that task certainly does belong in the economics wheelhouse.

The intertwining of the far right and Austrian economics

Regardless of ideological differences, readers ought to consider the economic theories and evidence critically when encountering a self-described Austrian economist in the present day.

Unfortunately, Austrian economics’ fondness for thought experiments, de-emphasis of quantitative rigor, and the label “economics” itself has caused the school of thought to be an attractive ideological tool for disingenuous actors in contemporary times. Because these facets of the school lower the barrier to entry for individuals who haven’t studied economics (at least to feel that they are competent economists), they have allowed unsavory groups, including far-right ideologues, to flock to “Austrian economics” as a means of disguising hateful ideologies as “economic theories”.

Austrian economic theories heavily favor unregulated free markets, and are against almost every form of government intervention. These facts, too, tend to attract political actors who fall into libertarian, anarchist, or right-wing camps, who then tout the theories of Austrian economics as a priori fact and use them to push their own policy agendas without much factual backing.

Further, this lower barrier to entry required by Austrian views encourages the development of “armchair economists”. This is in line with the general decline in trust of experts that has plagued society in the 21st century. It’s easier for an individual with a moderate view to read the writings of extreme “Austrian economist” conservatives touting these a priori theories as fact, than it is for them to work through a detailed economic paper using quantitative methods that provide a sound empirical basis, let alone study a degree in economics and learn about the vast depth of nuance that characterizes modern economic research on topics that might seem obvious at first – like the effects of a minimum wage.

These actors may then very well consider themselves on par with professional economists, and even write “economics” opinion pieces without any sort of formal training, and repeat ideas that far-right actors have pushed as economic truth.

For example, racist individuals can point to Austrian school style non-interventionism to push the idea that affirmative action, or any sort of policy that benefits minority interests, are destructive and should never be implemented for any reason. Similarly, any government redistribution programs – such as those to alleviate poverty, support retired veterans, etc. – are considered wasteful and a net loss for society.

These views easily lend themselves to the types of far right-wing ideas that quickly spiral into anti-immigrant, racist, or other ultra-conservative positions. For example, far-right ideologues can take the anti-affirmative action or anti-redistribution stance, and go a direct step of (bad) logic further to state that these policies are really just discrimination against white people, decry them as morally wrong, and stoke the flames of racist anger – while hiding behind the guise of analyzing society as an unbiased “economist”.

Image credit: Freepik.com.

Sometimes, these actors may use Austrian positions to denounce the work of professional economists, central banks, and governments. And, a proportion of “armchair” Austrian economists may completely disregard the findings of economics professionals. Be wary of such discourse, and be sure to look to the evidence, research, or teachings backing any self-described Austrian positions, to determine what lines of reasoning are based on legitimate economic theorizing, and which are not.

Be aware of bad-faith critiques of professional economists

Whether connected to political agendas or not, there are modern-day Austrian economists who disparage the field of economics at large. The label “economics” has given a sense of legitimacy to these actors, emboldened by the writings of so-called Austrian economists who may have an agenda.

Some of these writings come from self-described Austrian think tanks or other ideologically-focused organizations. One clear example is Jonathan Newman’s writing for the Mises Institute. In a March 2024 article, “Economics Needs a New Methodenstreit Based on Austrian Methodology”, Newman sets about criticizing mainstream economics (“Even a cursory look at what passes for economic scholarship in mainstream journals today shows that the methodological errors that were exploded by Menger and Mises persist”).

One of the underlying assumptions in Newman’s writing is that state intervention is always undesirable – such that it is a foregone conclusion that the American Economic Review articles he shares must be biased because they conclude that state intervention or government programs led to positive results in some cases. His article also notably demonstrates the disdain for econometric methods common in modern Austrian economics discourse. Newman’s third and fourth examples of poorly-done economics research are simply an abstract about econometric methodology and a screenshot showing several equations. These are apparently evidence of those papers’ lack of usefulness.

As another, more in-depth example, Henry Hazlitt’s 1946 book Economics in One Lesson3 is a popular and acclaimed read among contemporary Austrian economists. Unfortunately, the book contains a large amount of disingenuous language that seeks to discredit professional economists, and proposes the Austrian model of thinking as the obviously superior alternative. The following quotes offer examples taken from the book.

“…the whole of economics can be reduced to a single lesson, and that lesson can be reduced to a single sentence. The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups…Nine-tenths of the economic fallacies that are working such dreadful harm in the world today are the result of ignoring this lesson.” (page 5)

Here, Hazlitt attempts to reduce the entirety of economics to one sentence, and in the same breath claims implicitly that economists routinely fail to consider longer-term effects of their policy suggestions.

“But comparatively few people today make this error; and those few consist mainly of professional economists. The most frequent fallacy by far today, the fallacy that emerges again and again in nearly every conversation that touches on economic affairs…the central sophism of the “new” economics, is to concentrate on the short-run effects of policies on special groups and to ignore or belittle the long-run effects on the community as a whole” (page 5)

This quote more blatantly targets “professional economists” as people who fail to consider long-run effects of their policy recommendations, a fallacy that other people would not make.

“An elementary fallacy. Anybody, one would think, would be able to avoid it after a few moments’ thought. Yet the broken-window fallacy, under a hundred disguises, is the most persistent in the history of economics…It is solemnly reaffirmed every day by great captains of industry…by learned statisticians using the most refined techniques, by professors of economics in our best universities. In their various ways they all dilate upon the advantages of destruction…they see almost endless benefits in enormous acts of destruction. They tell us how much better off economically we all are in war than in peace.” (page 13)

This quote from Hazlitt stands out as a neat summary of a chapter that disingenuously presents economists as professionals that celebrate destruction. Hazlitt correctly identifies that destruction is not good, and in fact that it’s wasteful when the money that would have gone towards other things must go towards rebuilding instead. However, he asserts that professional economists do not make this connection.

“The analysis of our illustrations has taught us another incidental lesson. This is that, when we study the effects of various proposals…the conclusions we arrive at usually correspond with those of unsophisticated common sense.” (page 177)

This quote from Hazlitt’s book asserts the idea that correct economic conclusions “usually correspond with those of unsophisticated common sense”. This is, clearly, a minimization and denunciation of the field of economics at large.

The above direct quotes are filled with bold claims about the ineptitude of professional economists. This type of charged language is a red flag signifying that the written work itself has not been written with a full understanding of economics, its aims, and role in decision making. Nor, clearly, has it been written in good faith, or without bias. It should be clear that these types of emotionally-charged critiques of mainstream economics often contain dishonest assertions and sweeping generalizations about how economists think, advise, and research.

To believe that the scores of professional economists working around the globe are unwilling or unable to consider the consequences of the policies they research, support, or criticize, is to think that all economists are short-sighted at the very best – and is a blanket insult to the profession.

Yet they come from a self-described Austrian economist who did not study economics. The author of the book, Henry Hazlitt, was a journalist who wrote for the business and finance sections of several publications. However, his writing is often cited by present-day “Austrian economists” and touted as fact.

In summary: the legacy and pitfalls of Austrian economics

In summary, then, readers should take care when encountering self-described Austrian economists. In the past, such economists did contribute to economic theory and helped to advance the field. Today, however, Austrian economics has remained rooted in the past such that it is no longer considered mainstream, preferring to remain with thought experiments and eschew the empirical research that economics at large has embraced. Further, the label “Austrian economics” is often applied to harmful or disingenuous political positions, to grant them an air of legitimacy that the average member of the public may not be informed enough to think twice about.

The best legacy of Austrian economics is the serious theorizing that gave rise to concepts like marginal analysis and opportunity cost, and Friedrich Hayek’s Nobel Prize-winning study of money and economic fluctuations. But unfortunately, readers must be wary of ultra-conservative, anti-expert pundits and self-described economists who take the label to further their own, sometimes problematic and politically-charged ideas without substantial evidence to back them.

References

1: Yeager, Leland B. (1997). "Austrian Economics, Neoclassicism, and the Market Test". Journal of Economic Perspectives. 11 (4): 153–165.

2: Samuelson, Paul A. (September 1964). "Theory and Realism: A Reply". The American Economic Review. American Economic Association: 736–739.

3: Hazlitt, H. (1946). Economics in One Lesson. Harper & Brothers Publishers. First edition reprint accessed at https://www.liberalstudies.ca/wp-content/uploads/2014/11/Economics-in-One-Lesson_2.pdf.

Header image credit: Fair use image of Friedrich Hayek retrieved from Wikipedia at https://en.wikipedia.org/wiki/File:Friedrich_Hayek_portrait.jpg.

-

- Prize / Contest

- Posted 1 week ago

2026 Best Paper Awards on Gender Economics - Two Prizes worth €2500 each

Starts 30 Jun at UniCredit Foundation

-

- Postdoc Job

- Posted 1 week ago

Postdoctoral Research Fellow - New Zealand Policy Research Institute

At Auckland University of Technology (AUT University) in Auckland, New Zealand

-

- Workshop

- Posted 1 week ago

Call for Papers. The Legacy of Adam Smith Workshop | 22 June 2026 | Edinburgh

22 Jun in Edinburgh, United Kingdom