Economics Terms A-Z

Price Ceiling

Read a summary or generate practice questions using the INOMICS AI tool

A price ceiling, also called price cap, is the maximum price that a seller is allowed to charge for a particular good or service by law.

It is an instrument of market regulation that governments may use to ensure that firms do not abuse their market power by charging consumers excessively high prices.

Particularly for goods that are considered a necessity (such as utilities like water and electricity) the government may establish price ceilings to protect consumers. In cases like water and electricity, society may not be efficiently served if these utilities were left to a competitive market, so price controls can help. Price ceilings are also sometimes used temporarily in exceptional situations such as during times of war or famine. For example, during the COVID-19 pandemic some countries established price ceilings for hand sanitizer after observing extreme increases in the price for this product.

What is the impact of a price ceiling on consumers and producers? Let us consider a perfectly competitive market where market demand is given by \(q_{D}=10-p\) and market supply is \(q_{S}=2p-2\). The market price in this unregulated market is equal to 4.

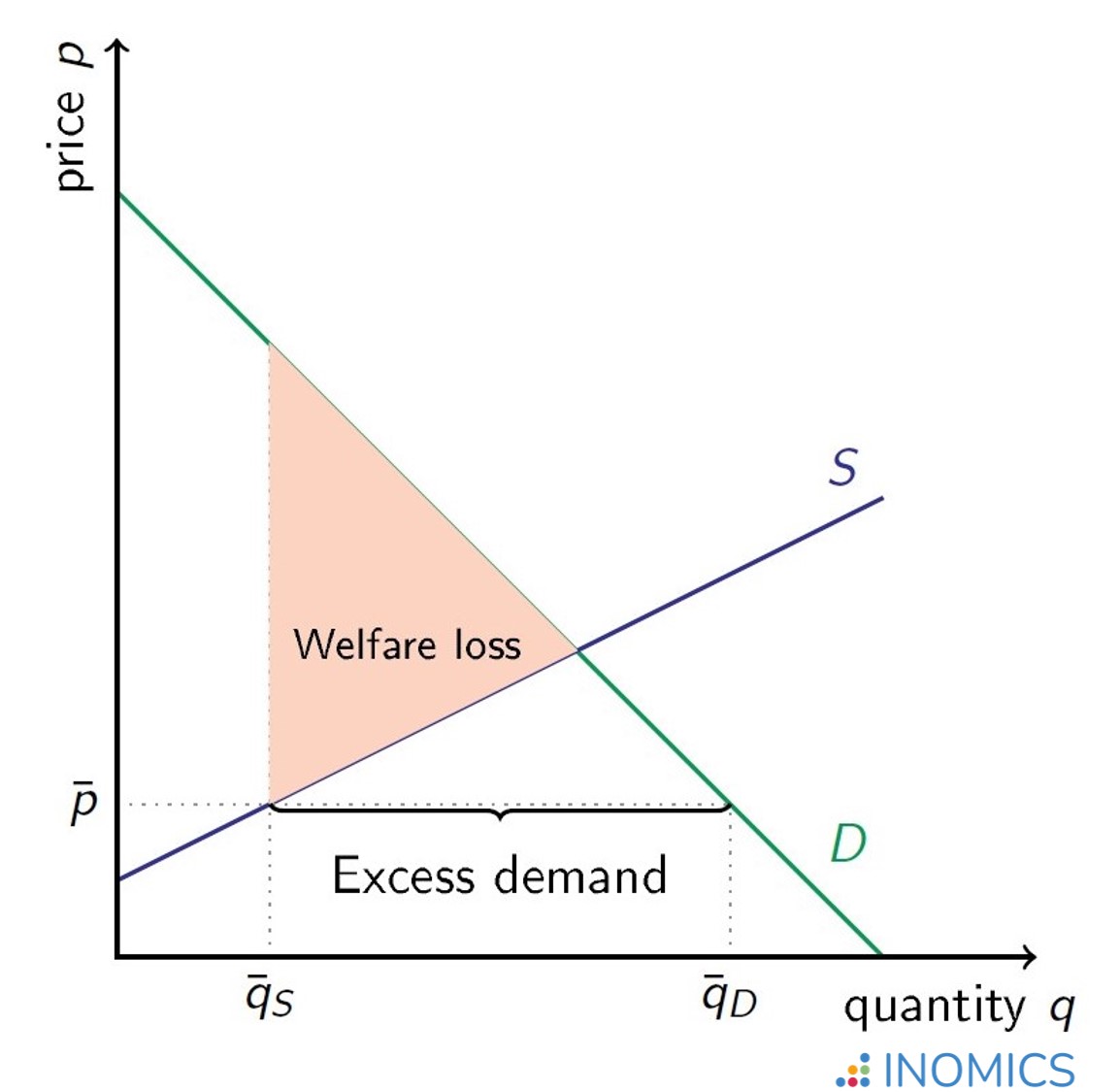

Now suppose that the government fixes a price ceiling at \(\bar{p}<4\). As this price is lower than the market price, some customers who were not able to buy at the market price would now likely buy the good. The quantity demanded increases to 8. The quantity supplied, on the other hand, decreases, because at a price of 2 it is less profitable to sell the good. Quantity supplied decreases to 2 units. As the quantity demanded now exceeds the quantity supplied, there is excess demand. This scenario is illustrated in the figure below.

In the case of a price ceiling below the market's equilibrium price, producer surplus decreases (in the figure: the triangle described by the area below \(\bar{p}\) and above the supply curve). Consumer surplus may increase or decrease depending on the demand function and the height of the price ceiling. Total welfare decreases, due to the decrease in the quantity exchanged. The shaded orange area is the deadweight loss that can be attributed to the price ceiling.

Figure 1: Welfare loss and excess demand caused by a price ceiling

Price floor

A price floor is the opposite of a price ceiling: it is the lowest price that can be charged by law. The most well-known example of a price floor is the minimum wage. A price floor is another instrument of market regulation that governments may use.

The most well-known example of a price floor is the minimum wage. In markets where the demand side has market power and as a consequence can force the supply side to offer their good or service at extremely low prices, it can be beneficial to set a lower limit. This is the case in the labor market, where workers determine the supply of labor, while the firms determine the demand. In this example, the wage is the price of labor. It can be difficult and very costly for workers to refuse employment to drive up the price of wages, which is normally how a market would reach equilibrium.

The intention of a minimum wage is clear: The government is trying to prevent firms from exploiting the workforce by offering low wages. But why are some economists skeptical about the benefits of minimum wages?

To answer this question, we can again use our graphs of supply and demand to analyze how a minimum wage affects the labor market. Suppose supply is given by \(q_{S}=2p-2\) and demand is \(q_{D}=10-p\). The equilibrium allocation in this market (without government intervention) will be a price of 4 and a quantity of 6. If we interpret our market as the labor market, we could say that 4 is the hourly wage in equilibrium.

Now suppose the government decides to set a minimum wage. If this wage is below 4, the market allocation will not change as firms are already paying a wage above the minimum wage. But what will happen if the government sets a minimum wage equal to 5?

Firms will want to hire 5 workers at this minimum wage, while in total 8 workers would like to work at this wage. The difference between the quantity supplied and demanded (the excess supply) are the workers who do not get a job, and are therefore unemployed. That is why some economists argue that we have to be careful when setting a minimum wage as this may increase unemployment.

In general, a price floor above the market price will harm the demand side, that is, consumer surplus decreases. In the figure it is the area that corresponds to the triangle above \(\underline{p}\) and below the demand curve. Producer surplus may increase or decrease depending on the supply function and the price floor. Total surplus decreases, because the quantity exchanged decreases and there is a welfare loss, also called deadweight loss (DWL) described by the shaded orange area in the figure above.

In a perfectly competitive market, total surplus is maximized and any price regulation will cause efficiency to decrease. Perfectly competitive markets usually do not need to be regulated, but if one side of the market has market power (e.g. if the seller is a monopolist), price regulations may actually improve efficiency and decrease welfare loss.

Further reading

In the simple model of a perfectly competitive labor market, a minimum wage that is higher than the equilibrium price (or wage in this case) causes unemployment to rise and decreases efficiency. But, many markets are not perfectly competitive, and government interventions such as price regulations may improve efficiency. Cahuc and Michel (European Economic Review, 1996) show that minimum wage legislation may foster economic growth, because low demand for unskilled labor may create incentives for workers to build up more human capital.

Good to know

The International Monetary Fund advises all countries to use price controls if this helps to “guarantee the functioning of essential sectors.” During the COVID-19 pandemic in 2020 various countries did so, setting price ceilings for different goods. Some countries established price caps for essential goods such as masks, hand sanitizer or toilet paper. Price ceilings during “normal” times are sometimes used to regulate markets for goods such as medication or utilities.

On December 19, 2022, the European Union introduced price controls on gas due to the energy crisis, which is another example of an (arguably) efficient use of price controls. The energy crisis, caused by supply chain disruptions and the war in Ukraine, caused concerns about the increasing prices of heating for people’s homes. The EU’s agreement sets a price limit on gas if it exceeds a certain point for more than 3 days, which limits how expensive heating will be for EU citizens during the winter. This can be economically efficient if the deadweight loss from regulating the price of heating is outweighed by the increased utility to consumers, who enjoy health and wellness benefits from additional warmth during the winter.

-

- Postdoc Job

- Posted 2 weeks ago

Postdoctoral Research Fellow - New Zealand Policy Research Institute

At Auckland University of Technology (AUT University) in Auckland, New Zealand

-

- PhD Program, Program, Postgraduate Scholarship

- Posted 1 week ago

PhD in Economics 2026/2027 - Five fully funded 4-year scholarships available

Starts 1 Oct at Scuola Superiore Sant'Anna in Pisa, Italy

-

- Postdoc Job

- Posted 1 week ago

Two-year Postdoctoral Research Position in Economics

At Department of Economics and Management, University of Padua in Padova, Italy