Economics Terms A-Z

Deflation

Read a summary or generate practice questions using the INOMICS AI tool

Deflation describes a general decrease in the price level of goods and services in an economy. Put differently, deflation is negative inflation; unfamiliar readers are encouraged to take a look at Inflation first.

At first glance, deflation may seem like a good thing. Falling prices mean that the purchasing power of money already in the economy increases. That is, the same amount of money can buy more goods and services. However, deflation is usually the consequence of a deteriorating economy, appearing alongside rising unemployment, wage cuts, and falling business profits. It also causes the real value of existing debt to increase, which makes paying off debt incredibly difficult, discouraging investment and possibly causing a debt crisis.

Drivers of deflation

Economists distinguish three central causes of deflation:

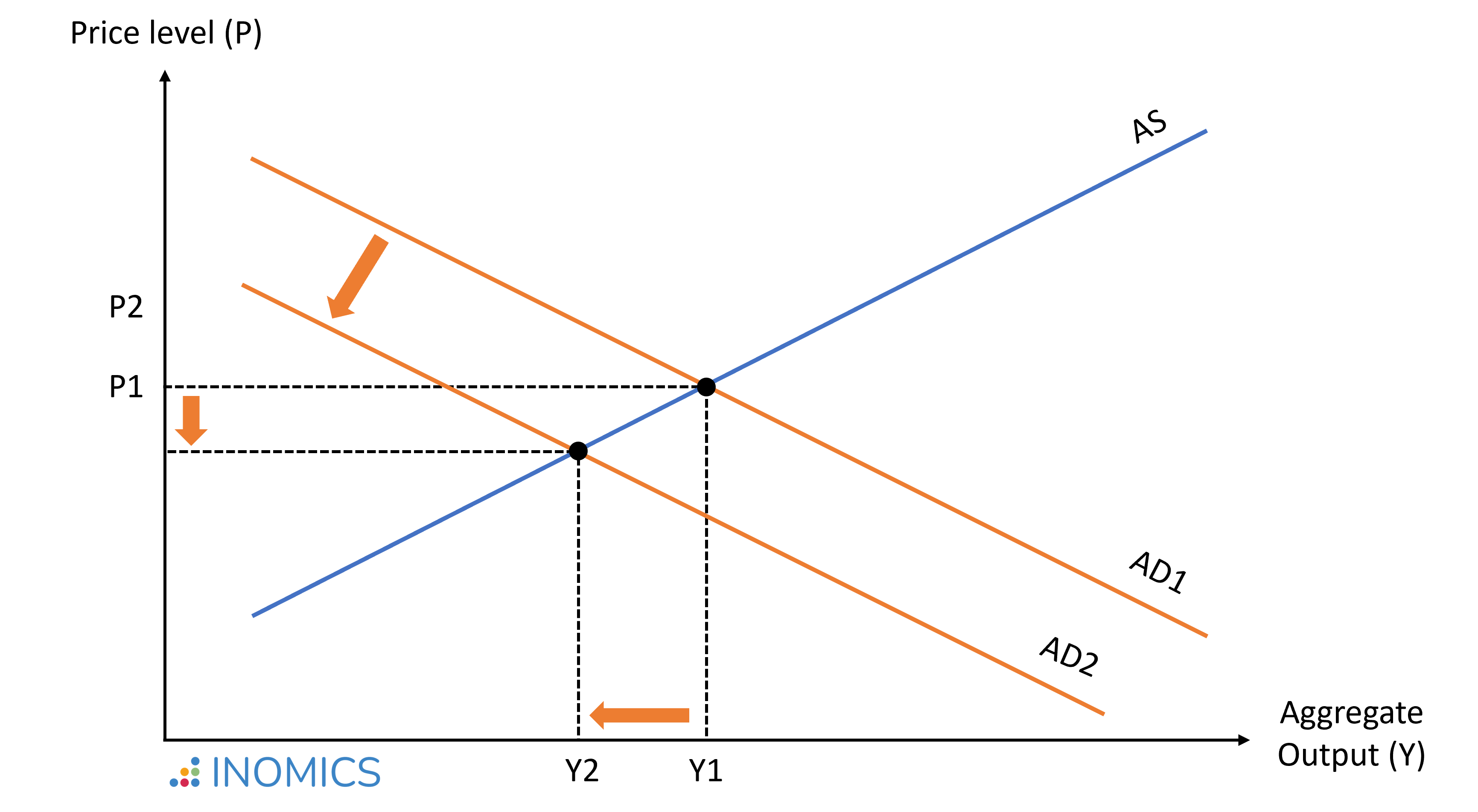

Demand-driven deflation

The main and most problematic cause of deflation is a drop in aggregate demand (AD) in reaction to a severe economic downturn – or the anticipation thereof. If consumers anticipate employment and incomes will fall, they reduce spending (the AD curve shifts inwards). Confronted with this decline in demand, companies will reduce aggregate supply (AS) and lower prices to compete for fewer customers.

In this setting, deflation can easily become cumulative, creating a deflationary spiral that can intensify the economic downturn. If customers delay purchases in anticipation of further price declines, this reduction in spending will cause prices to fall, which will encourage more waiting and more price declines.

Figure 1: Demand-driven deflation

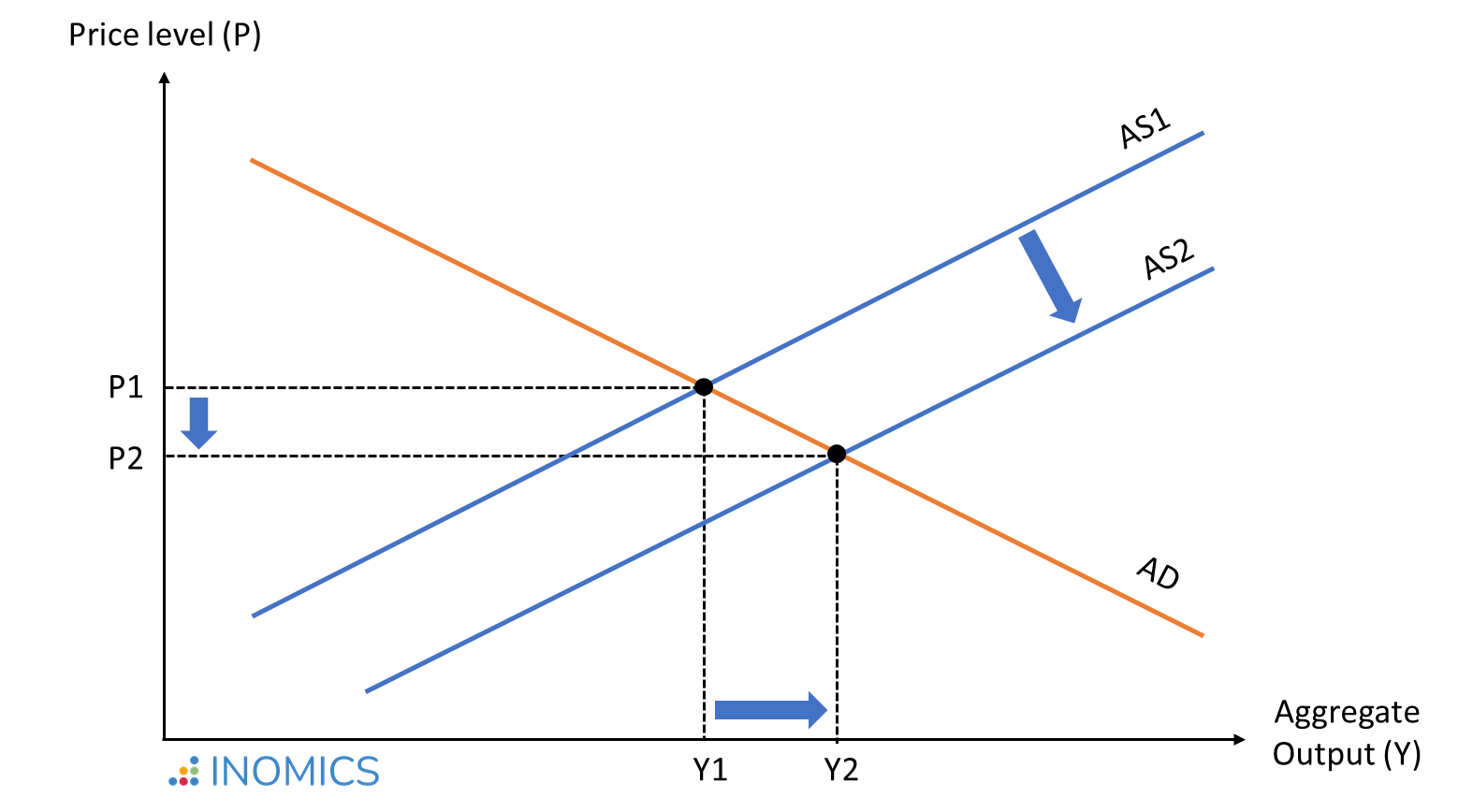

Supply-driven deflation

On the contrary, “good” or “benign” deflation can occur when the aggregate supply of goods and services increases faster than aggregate demand, resulting in falling prices. This may be driven by a price decline for key input factors, or advances in technology resulting in rapid productivity improvements (the AS curve shifts outwards). In this case, deflation can be consistent with higher rates of economic growth.

Figure 2: Supply-driven deflation

Monetary deflation

A reduction in money supply can also contribute to deflation. For example, if the interest rate is increased during a period of economic downturn, this would further reduce consumer spending. Contrarily, increasing the supply of money by lowering the interest rate can counter deflation.

In the wake of the 2008 financial crisis and the COVID-19 pandemic, many advanced economies featured interest rates at record lows in order to stimulate growth. However, this low-rate environment means that central banks cannot reduce the interest rate further in case of deflationary pressures. This has been a main concern regarding the low interest rate environments prevalent in many advanced economies after crises, and is one reason why central bankers justify raising interest rates again.

Good to know

Prolonged periods of deflation are relatively rare, most commonly occurring in settings of severe recession. For example, in the United States, prices dropped substantially during the Great Depression, particularly between the years 1930 and 1933. This was due to a combination of factors, including overproduction in agriculture during the 1920s, a fall in aggregate demand, surging unemployment that peaked at 25%, as well as a fall in money supply due to bank failures.

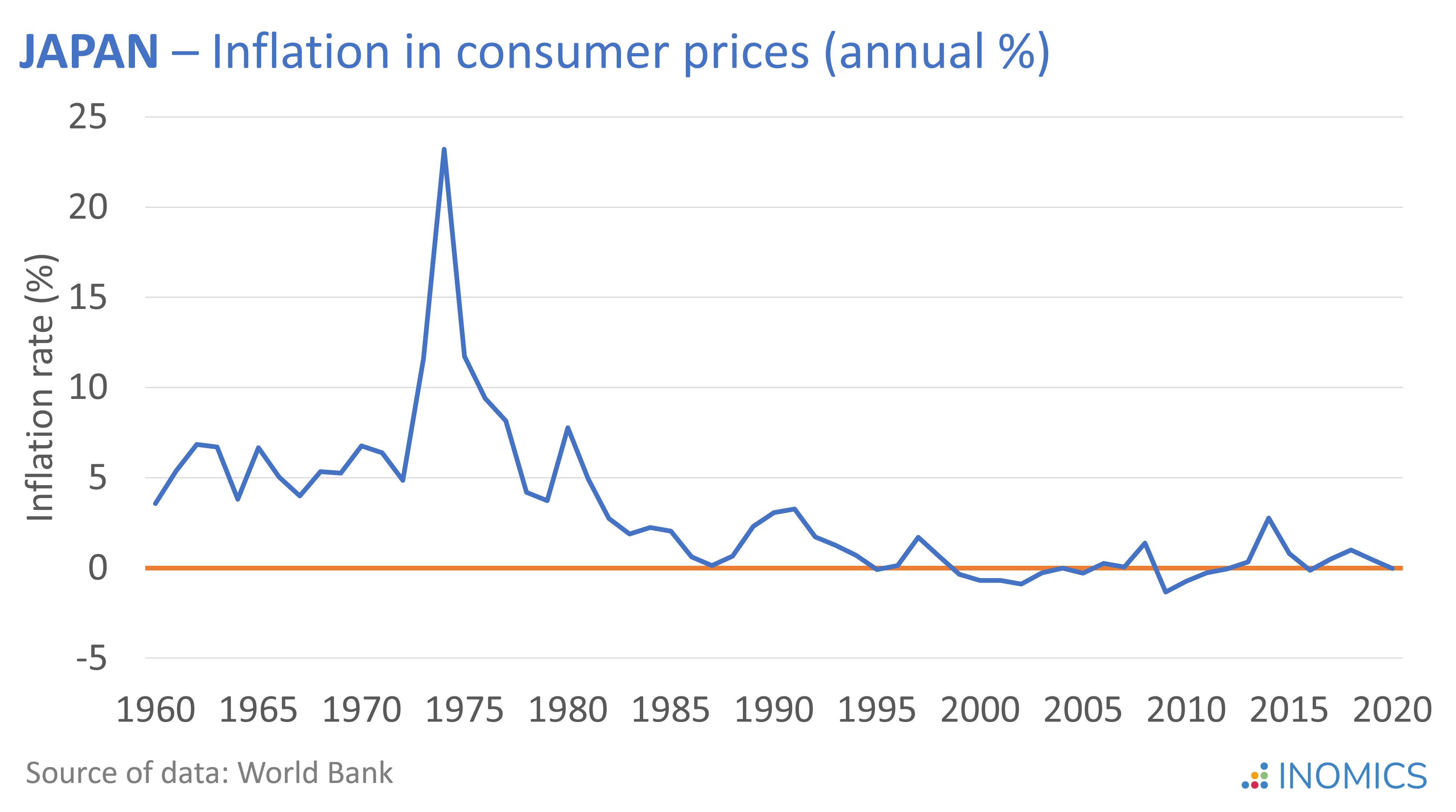

An exceptional example of chronic deflation is Japan. The country has suffered from mild but long-lasting deflation for more than two decades, since the mid-1990s. During the 1970s, Japan was the world’s second-largest economy after the United States and, by the late 1980s, ranked first in terms of per capita gross national product worldwide.

However, in the early 1990s Japan entered a period of significant economic slowdown, characterized by low growth and deflation, which became known as the “Lost Decade”. The initial shock was linked to speculation that fueled stock market and real estate bubbles that eventually burst, resulting in a debt crisis and several government bailouts.

The Bank of Japan has explored several measures to revive the national economy through expansive monetary policy. It adopted a zero-interest rate policy in 1999 and introduced quantitative easing – a type of monetary policy that injects liquidity to the financial system by purchases of government bonds – in 2001, ahead of other central banks.

However, these measures could not create sufficient consumer and market confidence. Inflation expectations remained low, consumers continued to save, and economic activity and prices remained relatively stagnant.

-

- Scholarship, Conference, Prize / Contest

- Posted 1 week ago

Call for Applications: Gateway to Global Aging Education Research Hackathon

Between 27 Jul and 30 Jul in Washington, United States

-

- Summer School, Event, Supplementary Course, Workshop

- Posted 2 weeks ago

Institutional and Organizational Economics Academy (IOEA) 2026

Starts 6 Apr at Université Paris-Dauphine and Scientific Research Institute of Cargese in Cargèse, France

-

- Postdoc Job

- Posted 6 days ago

Postdoctoral Research Fellow Opportunity

At University of Notre Dame in Notre Dame, United States