Economics Terms A-Z

Consumer Surplus and Producer Surplus

Read a summary or generate practice questions using the INOMICS AI tool

Consumer surplus is the gain made by consumers when they purchase an item at the competitive market price rather than the (highest) price that they would have been willing to pay for it. Analogously, producer surplus is the gain made by producers when they sell an item at the market price rather than the (lowest) price that they would also have accepted for it.

In competitive markets for consumer goods and services there are typically many producers selling the items and many consumers purchasing them. Participation in the free market is more attractive for producers, the higher the price at which they can sell their product. The quantity of the item offered on the market thus increases as the price increases and the supply curve is generally upward-sloping.

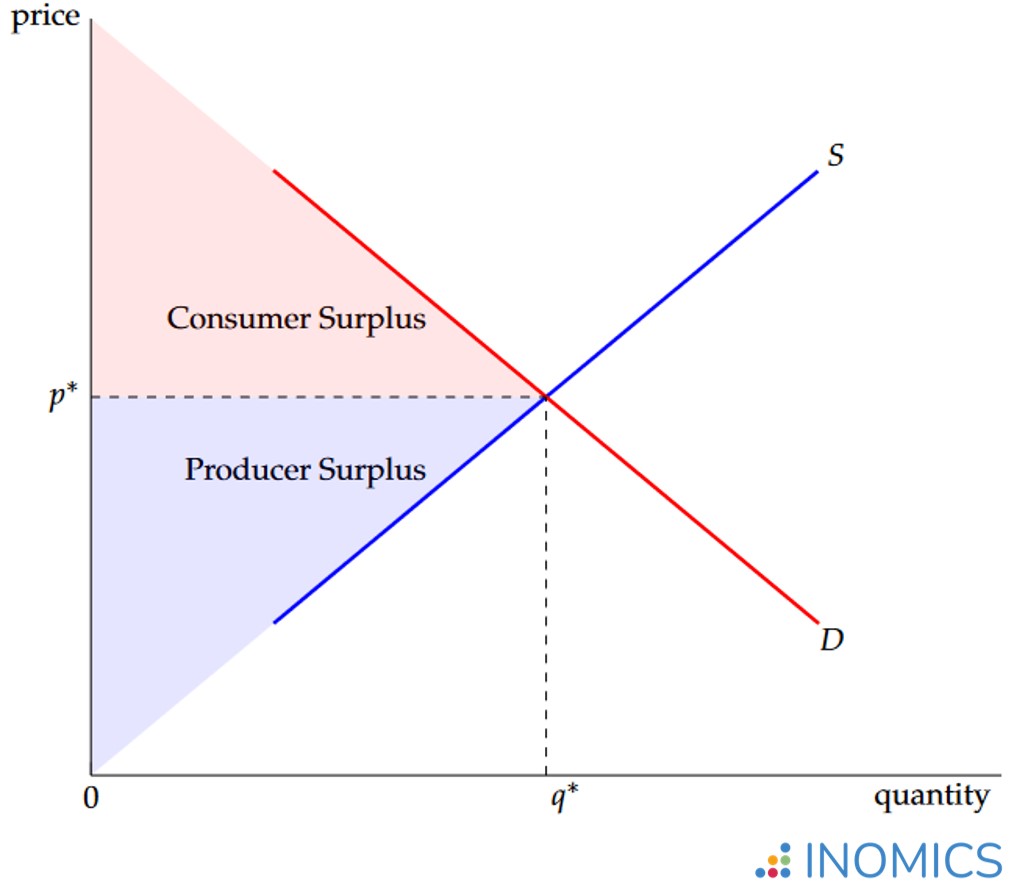

Conversely, participation in the market is more attractive for consumers, the lower the price at which they can purchase the item. The quantity demanded thus increases as the price falls and the demand curve is generally downward-sloping. The market equilibrium, consisting of the item’s price p* and quantity q* bought and sold, is determined where supply meets demand, i.e. where the supply and demand curves cross.

For lower quantities of the item than q*, consumers in the market would be willing to pay a higher price than p*. However in the equilibrium they are able to purchase and consume all q* of the item at price p* per unit.

The difference between the higher prices they would have paid for the lower quantities and those lower quantities priced at p* is the consumer surplus. This is a gain for consumers in terms of the value that they attach to the item in excess of the price they pay for it. The consumer surplus is represented in the graph below by the area below the demand curve D stretching to price level p*.

Figure 1: Depiction of consumer and producer surplus in a competitive market

Similarly, for lower quantities of the item than q* producers in the market would be willing to accept a lower price than p*. This is because typically it’s cheaper to produce fewer units. However, in the equilibrium they are able to sell all q* of the item at price p* per unit.

The difference between the lower prices they would have accepted for the lower quantities and those lower quantities priced at p* is the producer surplus. This is a gain for producers in terms of the money that they receive for the item in excess of the price at which they value it. The producer surplus is represented in the graph by the area above the supply curve S stretching to price level p*.

The sizes of consumer surplus and producer surplus are determined by the relationship between the elasticities of supply and demand. Ceteris paribus, the more elastic demand is for an item, the flatter the demand curve and the smaller consumer surplus will be. Price-sensitive consumers do not tend to value items much more than the price they pay for them!

Analogously, the more elastic supply of an item is, the flatter the supply curve and the smaller producer surplus will be. In a perfectly competitive market the supply curve is horizontal in the long run (supply is perfectly elastic) and producers make no profits; producer surplus then reduces to zero.

Both consumer surplus and producer surplus are somewhat hidden in reality. A reservation price is the private information of the individual who keeps it in reserve. How much a consumer is willing to pay or how little a producer is willing to accept for an item will only be revealed if they actually exchange the item at those prices.

Nevertheless, economic surpluses on both sides of the market can be estimated by observing consumers and producers joining and leaving the market over time, or by observing what happens in the market in response to various events such as major changes in markets for related items or government interventions.

Indeed, estimates of consumer surplus and producer surplus are important for guiding policy: a government considering a change in the tax on an item will be interested in who will bear its main burden in terms of forgone surplus (consumers or producers), and in estimating how much of it they will cede to the exchequer (i.e. how high the tax can be set).

Similarly, producers with market power will be interested in understanding consumer surplus in their markets and whether they can extract value from it through market segmentation and price discrimination. Occasionally, groups of consumers may also exert their power in numbers and negotiate lower prices with producers, effectively taking a cut from producer surplus.

Further reading

When new technologies or business models disrupt long standing markets, opportunities to find out how to calculate consumer and producer surplus are created! Economists Cohen, Hahn, Levitt, and Metcalfe collaborated with Jonathan Hall of Uber to estimate consumer surplus of US $2.9 billion in the market for taxi journeys while the UberX service was operating in 4 major US cities in 2015.

Projected to the whole of the United States, consumer surplus in the taxi market may have been as high as $6.8 billion that year, or $1.60 consumer surplus for every $1 spent on taxi journeys. See “Using Big Data to Estimate Consumer Surplus: The Case of Uber” (National Bureau for Economic Research, Working Paper No. 22627, 2016).

Good to know

A form of consumer surplus may also develop after the purchase of some goods. It has been shown in economics experiments that individuals tend to attach personal value to objects after they have obtained them such that they are unwilling to exchange them for the same price at which they purchased them. This is known in the literature as the “endowment effect”. Think about it: how hard would it be for you to part with your favorite pair of shoes or that special jacket?

-

- Conference

- Posted 2 weeks ago

1st Piraeus International Economic Conference (PIEC)

Between 28 Jun and 30 Jun in Spétses, Greece

-

- Conference

- Posted 1 week ago

XXVII Conference on International Economics

Between 28 May and 29 May in Ciudad Real, Spain

-

- Conference

- Posted 1 week ago

Industrial Policies in a Globalized and Financialized World

Between 7 May and 8 May