Economics Terms A-Z

Price Elasticity of Demand

Read a summary or generate practice questions using the INOMICS AI tool

The price elasticity of demand for an item A ϵA measures how the quantity of the item demanded qA changes in response to a change in the item’s price pA.

\begin{equation*}

\epsilon_A = \frac{\Delta\mathit{q}_{A}}{\Delta\mathit{p}_{A}} = \frac{\frac{d{q}_{A}}{\mathit{q}_{A}}}{\frac{d{p}_{A}}{p}}

\end{equation*}

Price elasticity of demand is generally negative because people tend to demand more (less) of an item as its price falls (rises). Precisely how sensitive demand is to changes in price depends on many things. Some factors include the type of item being sold, the availability of substitutes, the type of buyer, and the time period considered.

For example, basic food items such as bread tend to be price-inelastic: people adjust their demand in response to changes in price less than proportionately to the changes -1 < ϵbread < 0. This means that if the price of bread goes up 10%, quantity demanded will fall by less than 10%.

On the other hand, let’s consider the rise in price of a particular type of bread (“special bread”). If other types of bread that represent good substitutes for it do not change in price, then people may respond by reducing consumption of special bread. This could happen in (potentially greater) proportion to the change in price, i.e. ϵspecial_bread ≤ -1, or result in the purchase of other bread to replace it (see cross elasticity of demand). Demand for special bread would then be said to be price-elastic.

Whenever the quantity of an item demanded changes by at least as much, or disproportionately more, than a change in its price ϵA ≤ -1, the item is price-elastic. Tourism is one sector of the economy where items (transport, accommodation, food) tend to be very price-elastic: if holidays reduce (increase) in price then more (fewer) people will go on holiday.

Indeed, the demand for any goods and services that are not necessary for daily life tends to be price-elastic. Of course, what is considered a necessity for one person may not be necessary for everyone else in the economy. This is relevant for sellers of items in the market who often try to group their customers by price sensitivity and practice price discrimination (offering different prices to different groups) wherever it is profitable.

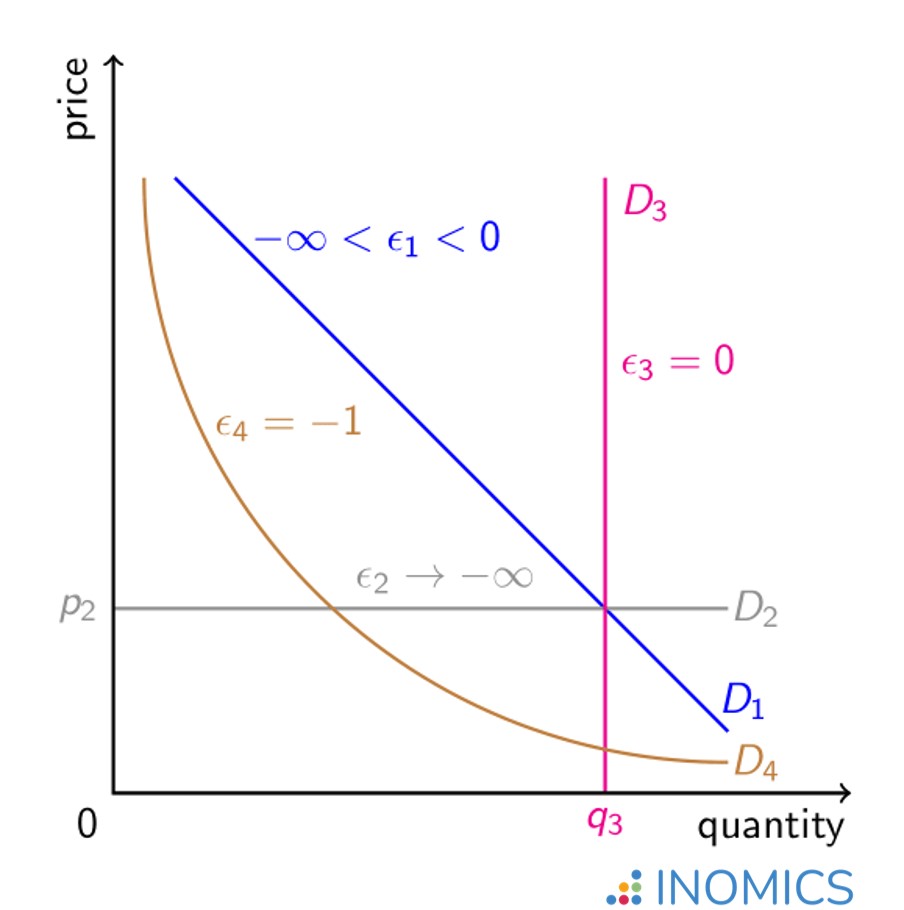

The demand curves for four standard theoretical cases of price elasticity are shown in the graph below. In the first case, the demand curve D1 is linear and downward-sloping. This implies that the price elasticity of demand for the item is negative ϵ1 < 0. However, note how price elasticity itself is not the same all the way along the curve. At high prices and low quantities, any change in price is small relative to the current price. Meanwhile any change in quantity demanded is large relative to the current quantity demanded. Demand is then price-elastic ϵ1 < -1.

But at the other end of the curve where prices are low and quantities high, any change in price is large relative to the current price, while any change in quantity is small relative to the current quantity demanded. Thus demand is price-inelastic -1 < ϵ1 < 0. It is not unreasonable to expect that the price elasticity of demand for an item depends in part on where the current market equilibrium lies. This in turn is determined by supply too and is therefore not shown in this graph.

The remaining three cases are less realistic but they form important benchmarks for demand theory. The second demand curve D2 is horizontal at a price of p2. In other words, the item is only demanded at a fixed price of p2. Any quantity of it is demanded at this price. The idea is that buyers are so sensitive to any change in price that quantity demanded will suddenly reduce to zero should the price go up. Inversely, demand will become infinite should the price go down. This is known as perfectly price-elastic demand ϵ2 → -∞. In practice, perfect price elasticity is improbable for any item.

The third and vertical demand curve D3 represents the other extreme: quantity q3 is always demanded, irrespective of the item’s price. People simply do not react to price changes: demand for the item is perfectly price-inelastic ϵ3 = 0.

Finally, demand curve D4, the only nonlinear example here, is special in that quantity demanded evolves exactly in proportion to any change in price. In this case, demand for the item is unitary price-elastic ϵ4 = -1. If the price decreases by 5%, quantity demanded rises by 5% such that total revenues from sales remain unchanged.

Another key feature of cases 2 to 4 is that price elasticity of demand is constant in all of them, i.e. ϵA is the same at any point on the corresponding demand curve. Unrealistic perhaps, but music to the ears of theoretical economists!

Figure 1: Various price elasticities of demand

In rare cases, demand for an item can increase in response to a price rise. For such items the demand curve will slope upwards and the price elasticity of demand will be positive ϵA > 0. The phenomenon of conspicuous consumption is one such case: goods or services that are bought in part to display the wealth of the owner or user. More wealth can be shown off at higher prices! For more on this, see the article on normal and luxury goods.

Another case is where price is a signal of quality, particularly for luxury items. If a higher price means the item has improved in quality then more of it may be demanded. Naturally, this only holds as long as buyers can distinguish between true and false signals of quality.

Price elasticity is a static theoretical concept. Therefore there is no time dimension in the definition of price elasticity. However, in practice, it is important to consider the time frame for responses to changes in price. People may not change their purchasing behavior in the short term; if they simply fill the supermarket shopping trolley with the same goods every week, then short-term demand will be price-inelastic. In the long term however, demand for items is more sensitive as people become aware of price changes and are better able to adjust their buying decisions accordingly.

Suggested Opportunities

- Conference

- Posted 20 hours ago

MIRDEC 26th MADRID 2026 Conference

Between 28 May and 29 May in Madrid, Spain

- Master's Program

- Posted 4 days ago

Master's programme in Quantitative Economics and Finance (MiQE/F)

Starts 31 Aug at University of St.Gallen in Sankt Gallen, Switzerland

Further reading

For a good appreciation of why price elasticity matters and an empirical overview of consumer sensitivity by food category in the United States for the entire period 1938 to 2007, see the study by Andreyeva, Long and Brownell, “The impact of food prices on consumption: a systematic review of research on the price elasticity of demand for food” (American Journal of Public Health, 2010).

Good to know

Governments have a keen interest in price elasticity of demand in order to judge where they can raise revenue through consumption taxes. In most economies, the government taxes tobacco products quite heavily. Some argue that this is done to discourage smoking for a healthier society. But the reality is that demand for cigarettes is price-inelastic: most smokers are addicted and will continue to purchase their regular dose regardless of price hikes through tax. The more price-inelastic an item, the greater its potential to provide juicy tax revenues. Of course, this introduces deadweight loss into a market, but it can be worth it if there is also a reduction in negative externalities (for example).

-

- Workshop

- Posted 4 months ago

14th PhD-Student Workshop on Industrial and Public Economics (WIPE) 5-6 February 2026

Between 5 Feb and 6 Feb in Reus, Spain

-

- Conference

- Posted 2 weeks ago

1st Piraeus International Economic Conference (PIEC)

Between 28 Jun and 30 Jun in Spétses, Greece

-

- Conference

- Posted 1 week ago

Industrial Policies in a Globalized and Financialized World

Between 7 May and 8 May