Economics Terms A-Z

Velocity of Circulation

Read a summary or generate practice questions using the INOMICS AI tool

The velocity of circulation is the frequency at which one unit of currency (i.e., a one-Euro coin) is exchanged in an economy within a given time period. If it is rising, then more transactions are taking place between individuals in an economy. It is also known as the velocity of money.

The velocity of money gives an indication of whether consumers and businesses are saving or spending their money. It is influenced by a variety of factors, such as the frequency of transactions, trade volume, business conditions, prevailing price levels and expectation regarding future prices, and borrowing and lending policies.

Being typically higher during periods of economic growth and lower during contractions and recessions, the velocity of money can be used as a measure of economic activity alongside other key economic indicators such as GDP, unemployment, and inflation.

Calculating the velocity of circulation

The velocity V of money measures the rate at which money is exchanged to purchase domestically-produced goods and services within a given period. Following Fisher's Equation of Exchange, V is calculated as the ratio of nominal GDP (output Y evaluated at current prices P) to money supply M:

\begin{equation*}

MV = PY \Longleftrightarrow V = \frac{PY}{M} \Longrightarrow V = \frac{GDP}{M}

\end{equation*}

While GDP is typically used as the numerator, gross national product (GNP) may also be used. In the denominator, two alternative measures for the average stock of money can be applied:

- M1 is the sum of currency, demand deposits, and other liquid deposits in circulation. It is typically used in shorter-term transactions of everyday consumption. When you buy something with cash or a card, you are using money from the M1 supply.

- M2 is a broader measure. It consists of M1 plus several assets that are less liquid but still easily convertible, such as savings deposits, money market securities, and other time deposits. Central banks closely follow the evolution of M2 as an indicator of money supply and future inflation. It is a common target of monetary policy.

To give an example, imagine an economy with two agents: a farmer and a mechanic. Both have initial cash holdings of €50, for a total stock of money equal to €100. In one year, the farmer produces wheat worth €100. However, before being able to harvest, he calls the mechanic to repair his tractor, for which the mechanic charges €50. The farmer then collects the wheat and sells the full harvest to the mechanic.

In this example, the money supply is €100 (since both the farmer and mechanic start with €50 each) and the nominal value of goods and services produced is €150 (€50 for mechanic services + €100 worth of wheat). The velocity of money is then calculated as 150/100 = 1.5. That is, each Euro in the economy changed hands from one agent to the other 1.5 times within the time period.

Factors affecting the velocity of circulation

According to the quantity theory of money, changes in the price level of an economy are explained by changes in the quantity of money in circulation, while keeping the number of transactions and the velocity of money constant. In this setting, an increase or decrease in the price level would occur solely due to an increase or decrease in the quantity of money.

In reality, the velocity of money may change in reaction to a variety of factors, including but not limited to the following:

- Money supply: The velocity of money depends upon the supply of money in the economy. If prices are “sticky'' in the short term and output is fixed, then a reduction in the supply of money would lead to an increase in the velocity of money.

- Frequency of transaction: Generally, the velocity of money increases with the frequency of transaction. In a climate of favorable business conditions and expanding trade volume, the velocity of money will increase. Contrarily, it will decrease in a climate of reduced economic activity.

- Behavioral responses: The velocity of money also depends on people's behavioral responses. For example, if workers are paid at regular intervals, they will spend their income more freely, while uncertain payment schedules lead people to hold on to cash reserves. Moreover, if people expect prices to rise and the value of money to decline in the near future, the rate of circulation will increase as people prefer spending their money rather than holding on to it.

Good to Know

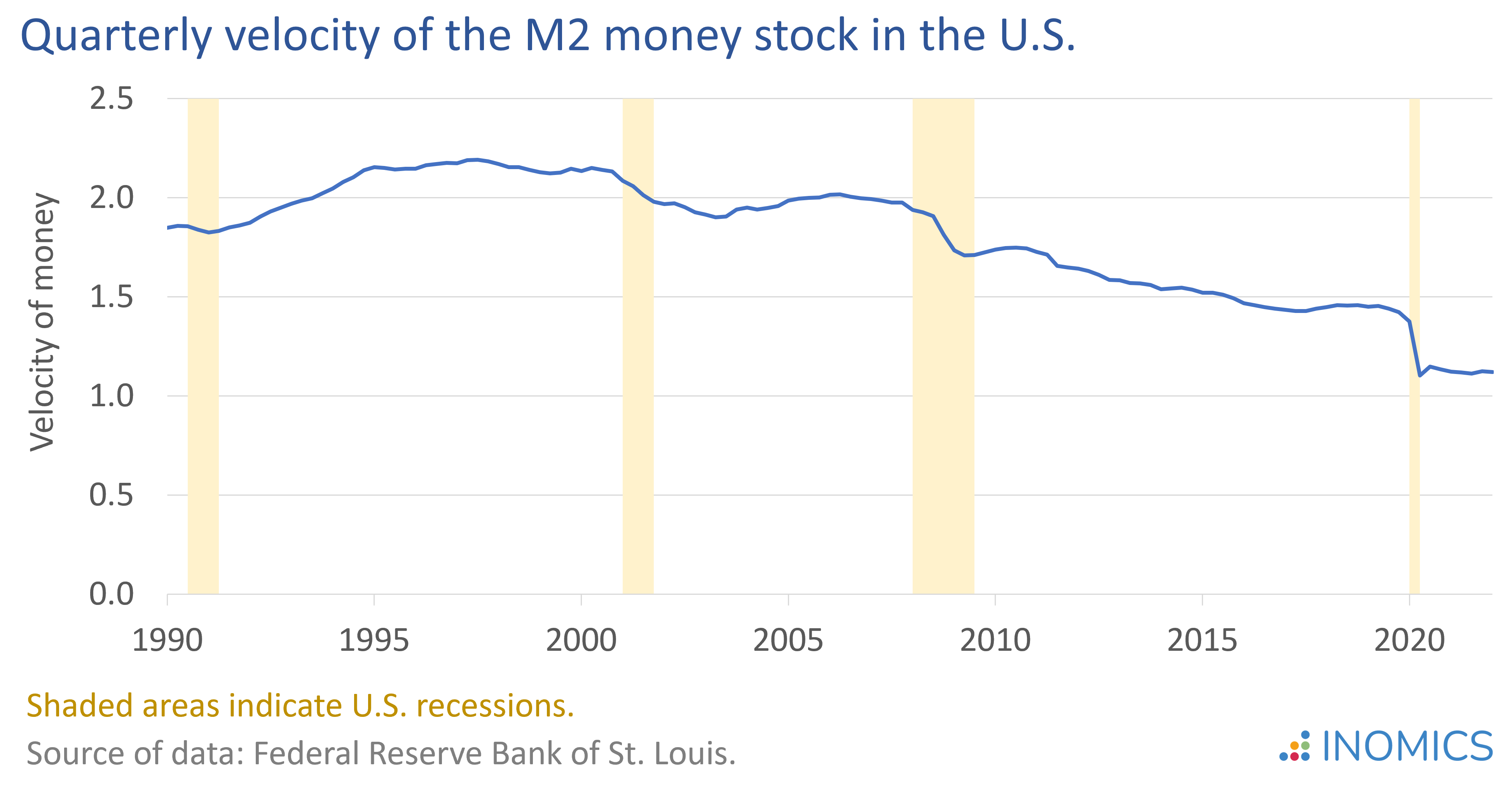

The figure below displays the quarterly velocity of the M2 money stock in the United States from the first quarter of 1990 to the first quarter of 2022. It can be seen that the steepest declines in the velocity of money generally coincided with periods of recession (the shaded regions in the graph) in the U.S., including the Great Recession between 2007 and 2009 and the economic shock of the COVID-19 pandemic and associated lockdown measures in early 2020.

-

- Conference

- Posted 1 week ago

46th RSEP International Conference on Economics, Finance and Business

Between 17 Apr and 18 Apr in Paris, France

-

- PhD Program, Program, Postgraduate Scholarship

- Posted 1 day ago

PhD Program in Economics - 6 Fully Funded Scholarships

at Luiss Guido Carli University of Rome in Rome, Italy

-

- Conference

- Posted 1 week ago

Macroeconomic Policy in a Heterogeneous and Imperfectly Rational World - 6th Joint NBP-LB-CEBRA Biennial Conference

Between 24 Sep and 25 Sep in Warsaw, Poland